Plan Framework

Housing

Housing Snapshot

The Texas A&M – San Antonio Area Regional Center has a small population of 1,400 people and just over 400 households. After attracting new housing development in the 2000s and growing at 7.8% annually from 2000 to 2010, population growth in the Texas A&M-San Antonio Area Regional Center slowed to under 3% annually since 2010, adding just under 300 new residents.

The majority of households in the Regional Center are considered family households and the area has an average household size (3.23) well above the City average of 2.71. The large presence of families means the median age of residents (25.9) in the Regional Center is significantly younger than the rest of San Antonio (34) and Bexar County (35.4). The population of the Texas A&M - San Antonio Area Regional Center is 87% Hispanic, higher than the 65% in the City. The Regional Center is more ethnically segregated than the City as a whole. The area has a Diversity Index score of 54 – measured from 0 to 100; this number represents the likelihood that two random persons in the same area belong to different race or ethnic groups. The City and Metropolitan Statistical Area (MSA) both have a Diversity index of 72. The average household income in the Regional Center is $58,800, compared to $70,000 for the City of San Antonio. The educational attainment level of the population in the Texas A&M-San Antonio Area Regional Center is lower than the overall City and largely does not match with the workers in the Regional Center. Of the area population aged 25 and older, 25% have less than a high school diploma (compared to 18% in the City and 15% in the MSA), and only 19% have an Associate’s, Bachelor’s, or Graduate/Professional degree (compared to 34% in the City.)

There is a small amount of existing housing stock in the Regional Center as the area is just starting to develop residential uses. There are two residential subdivisions of single-family homes and a scattered mix of single-family homes on larger, rural lots. The single-family home subdivisions were built primarily between 2000 and the present. Average home price in the Regional Center is approximately $180,000, which largely reflects the price point for homes in these two subdivisions.

There is only one apartment property in the Texas A&M-San Antonio Area Regional Center – The Rosemont at University Park. This 240-unit building was constructed in 2006 and is a subsidized, income-restricted apartment project renting to residents that earn lower than average incomes. Despite the lack of apartments, the Texas A&M-San Antonio Area Regional Center has a lower proportion of owner-occupied housing units than the rest of the city - 43% of units are owner-occupied compared to 53% citywide. New apartment developments near the Regional Center have been primarily along Loop 410 or within the Brooks Area Regional Center. The majority of new apartment development projects have been affordable, income restricted apartments and/or senior housing projects. The only market rate apartment developments have been in the Brooks redevelopment area or near the western edge of the City of San Antonio outside the I-410 Loop. There is one student dormitory on campus, Esperanza Hall; however, it is often limited to first year students. Currently, there is no off-campus apartment option within the Regional Center for students.

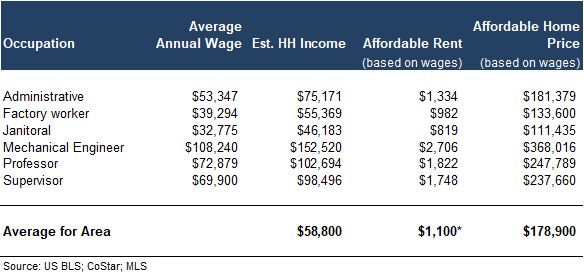

Jobs within the Regional Center, on average, provide wages and salaries that are equivalent to or higher than regional averages. An evaluation of the affordability of rental properties and for-sale homes based on prevalent occupations within the Regional Center shows that, on the whole, the most prevalent occupations in the Regional Center have wages high enough to afford rental products and for-sale homes in the area. Despite the lower than average housing costs of the area, most of the workers in the Regional Center live outside the Regional Center and many times much further north than the Regional Center.

Texas A&M-San Antonio Area Regional Center Affordable Rent and Home Prices for Prevalent Occupations

On November 7, 2019, the San Antonio City Council reassigned the Tax Increment Reinvestment Zone (TIRZ) from the Verano Land Group to SouthStar Communities for the Vida! San Antonio development, which will replace the former Verano Master Plan. The Vida! San Antonio project is a 600-acre development north of the University that will consist of over 5,700 residential units, including single-family homes, apartments, and townhomes, each with varying price ranges. The Vida! Plan will also provide an off-campus student housing opportunity.

The Regional Center is forecast to grow by 1,700 to 6,500 new households from 2010 to 2040. The estimated housing range is dependent largely on the future prospects of the Vida! San Antonio development. Development activity in the south San Antonio area indicates demand that supports the lower end of the estimate of 1,700 new housing units. However, a major master planned development could greatly impact demand. The higher end estimate assumes the build-out of the Vida! San Antonio development and attraction of additional housing development in the area.

Housing Challenges in the Texas A&M-San Antonio Area Regional Center

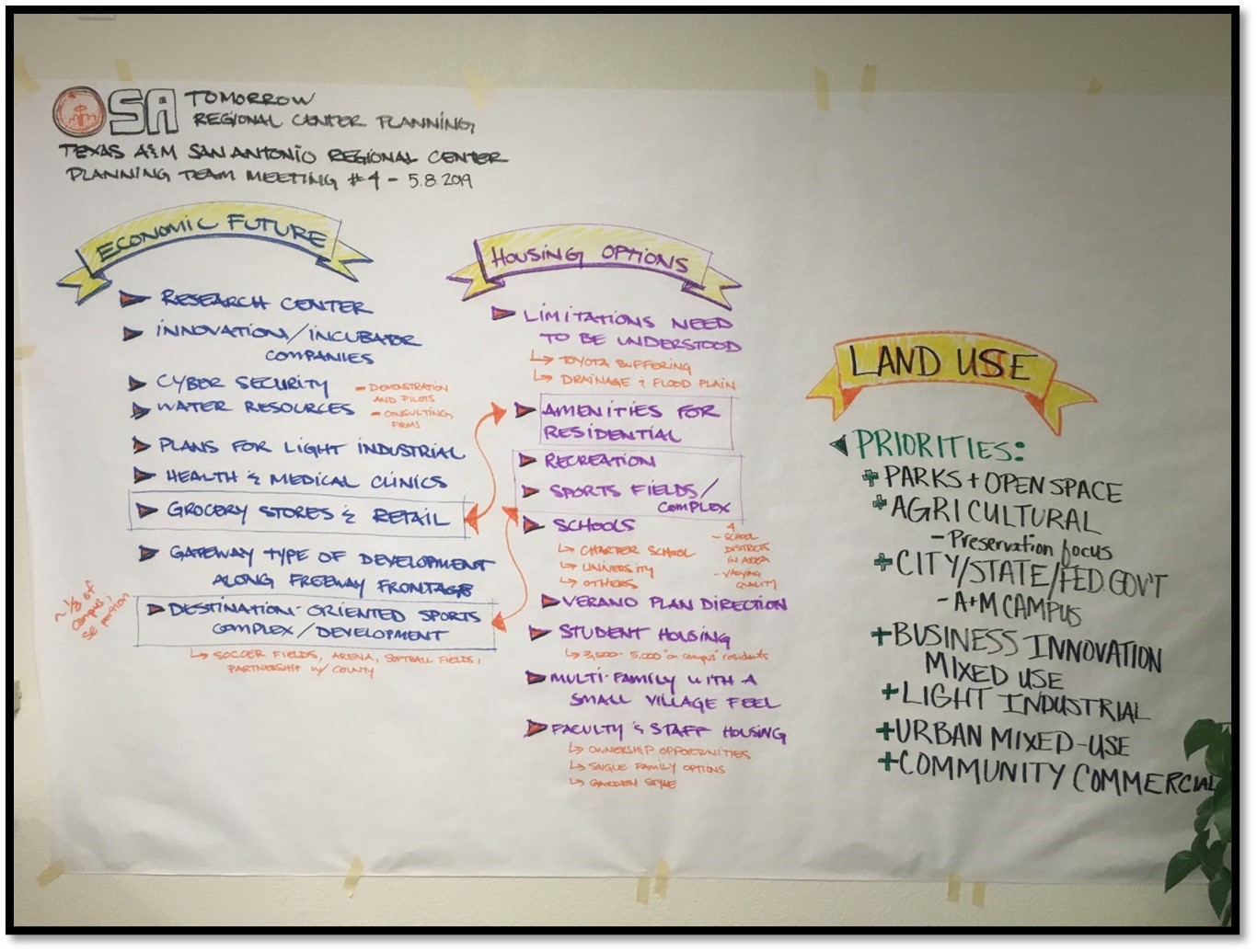

The Texas A&M-San Antonio Area Regional Center Planning Team completed an assessment of the Regional Center’s housing challenges as part of the two Planning Team meetings devoted to economic development and housing during the planning process. This analysis helped identify housing challenges that need to be addressed and missing housing types the plan can help capture.

Texas A&M-San Antonio Area Planning Team Analysis

Four housing challenges were identified for the Texas A&M-San Antonio Area Regional Center.

Vida! San Antonio Development: The Vida! San Antonio development will have a significant impact on the amount and mixture of housing in the Regional Center. A large portion of land that can be developed as housing in the area is within that project’s boundaries. A diverse mixture of housing in the Regional Center is largely dependent on the ability of this development to provide a range of product types and attract a diversity of residents.

Toyota Proximity: As part of the development agreement related to the construction of the Toyota Motor Manufacturing Plant (Toyota), the City will ensure appropriate land use planning protects public health and safety while also ensuring an environment that is supportive of additional job creators.

Desirability of the Area: The south side of San Antonio has primarily attracted housing development in recent years that is oriented towards entry-level homebuyers. New rental developments have been limited. The presence of major employers such as Toyota and the University has not yet spurred significant new housing development in the general area of the Regional Center. To attract residents, especially a diversity of residents and residents who work in the area, the desirability of new housing products must improve. Amenities and services that people desire in neighborhoods have to be present, including quality schools, access to retail goods and services, recreation/park/open space amenities, and others. New neighborhoods in the area have not been built in a comprehensive manner and lack these desired amenities in most cases. A more comprehensive approach to subdivision development and/or large, master planned developments is needed to create neighborhoods with diverse housing options and amenities.

Infrastructure: Infrastructure costs to support new housing development are high for many parcels in the Regional Center as there are significant topography, drainage, and utility service barriers. These infrastructure costs and challenges have and will continue to lead to piece-meal subdivision development that cannot produce the comprehensive neighborhood amenities desired by many buyers and renters. Support is needed for developments in the area to address sub-regional infrastructure challenges.